Amazon has introduced a new round of seller fee changes, continuing a trend that has significantly reshaped the economics of selling on the platform over the past few years. For third-party sellers, understanding these updates is critical—not just to protect margins, but to decide whether Amazon still fits their long-term strategy.

Here’s a clear breakdown of what’s changing, who is affected, and how sellers can adapt.

Overview of the Latest Amazon Seller Fee Updates

Amazon’s most recent fee adjustments primarily impact sellers using Fulfillment by Amazon (FBA), with changes targeting fulfillment costs, storage fees, and incentives tied to logistics efficiency.

The stated goal from Amazon is to:

- Encourage faster inventory turnover

- Reduce congestion in fulfillment centers

- Incentivize sellers to optimize packaging and storage

For sellers, however, the reality is more nuanced.

Key Fee Changes Sellers Should Know

1. Fulfillment Fees Continue to Rise

Amazon has adjusted FBA fulfillment fees across several size tiers. While increases vary by product category and dimensions, many sellers are seeing higher per-unit costs, particularly for standard and oversized items.

These increases disproportionately affect:

- Low-margin products

- Heavy or bulky inventory

- Sellers relying on price competition rather than differentiation

2. Storage Fees Are Becoming More Aggressive

Amazon is placing greater emphasis on inventory efficiency.

New and expanded fees target:

- Long-term stored inventory

- Products with low sell-through rates

- Sellers holding excess stock beyond recommended thresholds

For brands with seasonal products or slower-moving SKUs, this can significantly impact profitability if inventory planning is not adjusted.

3. Incentives for Faster Turnover and Better Packaging

Alongside fee increases, Amazon has introduced select incentives for sellers who:

- Maintain strong sell-through rates

- Use optimized, compact packaging

- Avoid excess inventory accumulation

While these incentives can offset some costs, they tend to benefit operationally mature sellers more than smaller or newer accounts.

Who Is Most Affected by These Changes?

The impact of Amazon’s latest fee updates varies by seller type:

Private-label sellers may feel pressure on margins but can adjust pricing and branding strategies.

Wholesale and arbitrage sellers are often hit hardest, as margins are already thin.

Large brands with strong demand may absorb the increases more easily, especially if they qualify for incentives.

Overall, sellers who treat Amazon as a “set-it-and-forget-it” channel are likely to feel the most pain.

How Sellers Can Adapt

Despite rising fees, Amazon remains a powerful sales channel. Sellers who adapt strategically can remain competitive.

Key steps include:

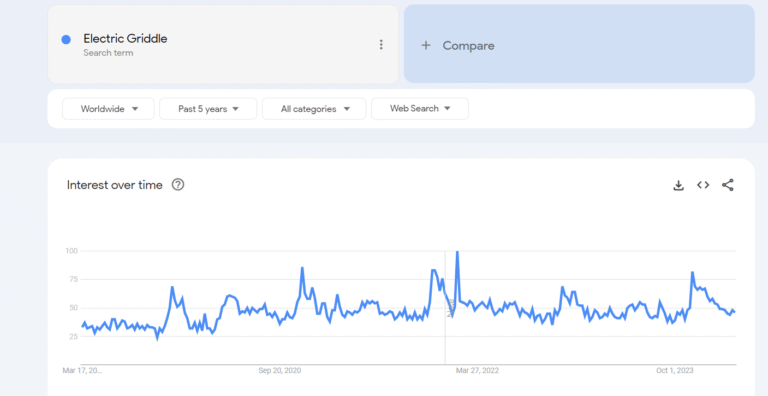

- Auditing SKU-level profitability more frequently

- Reducing slow-moving inventory

- Improving packaging efficiency to lower fulfillment costs

- Considering price adjustments or bundle strategies

- Evaluating alternative fulfillment or sales channels

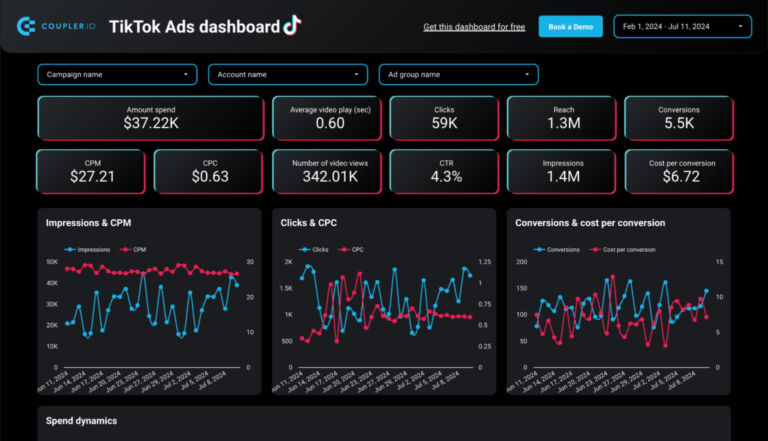

For some sellers, these changes may also accelerate diversification into platforms like Walmart Marketplace, TikTok Shop, or direct-to-consumer (DTC) channels.

The Bigger Picture: Amazon’s Long-Term Strategy

Amazon’s fee changes reflect a broader shift: the platform is prioritizing operational efficiency and profitability over unlimited seller growth. This aligns with Amazon’s continued investment in logistics, automation, and faster delivery expectations for customers.

For sellers, the message is clear—success on Amazon now requires tighter operations, better data, and more intentional inventory management.

Final Thoughts

Amazon’s latest seller fee changes won’t affect every seller equally, but they reinforce an ongoing reality: selling on Amazon is becoming more complex and more expensive.

Sellers who stay informed, adapt quickly, and treat Amazon as part of a broader ecommerce strategy—rather than the entire business—will be best positioned to navigate these changes.